Probate vs. Trusts: How Orange County Homeowners Can Protect Their Property and Legacy

Probate vs. Trusts: How Orange County Homeowners Can Protect Their Property and Legacy

Published by EJ Properties • Expert Care, Tailored Solutions

By Elyssa Matson Jones

When it comes to estate planning for property owners in Orange County, understanding probate and trusts can make all the difference in how assets are preserved and passed on. At EJ Properties, we help property owners plan wisely, manage assets, and protect their investments. Here is everything you need to know about probate, different types of trusts, and the pros and cons of placing your property in a trust.

Avoiding probate safeguards your family's privacy and saves valuable time and resources.

What Is Probate and How Does It Impact Property Owners?

Probate is the legal process of handling someone’s estate after they pass away. It includes:

- Validating the will (if available)

- Inventorying the estate assets such as real estate, investments, and personal property

- Paying off debts and taxes

- Distributing assets to the beneficiaries

Unfortunately, probate can be a long, expensive, and public process, sometimes taking months or years to complete. Probate fees in California often total up to 5% or more of the estate’s value, cutting into your heirs’ inheritance. That is why many homeowners and real estate investors consider trusts to avoid probate altogether, keeping their family’s financial matters private and their property secure.1

What Is a Trust and How Can It Help You?

A trust is a legal arrangement where a trustee holds and manages assets on behalf of beneficiaries, as directed by the person who created the trust, known as the grantor. Trusts can bypass probate, simplify the inheritance process, and, in some cases, reduce taxes or protect assets from creditors.

At EJ Properties, we encourage real estate investors and property owners to consider trusts as part of a smart estate strategy. Trusts come in various forms, each suited for different needs and goals. It is best to consult an estate attorney to determine which is right for you.

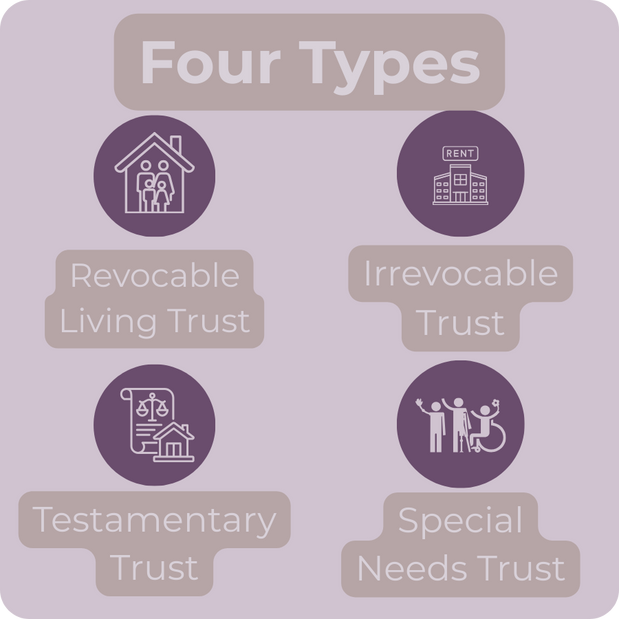

Types of Trusts for California Property Owners

1. Revocable Living Trust

- Definition: A flexible trust that can be changed or revoked by the grantor during their lifetime.

- Benefits: Avoids probate, allows the grantor to retain control over the assets, and simplifies the transfer of property.

- Considerations: Provides no creditor protection or tax benefits during the grantor’s lifetime.

2. Irrevocable Trust

- Definition: A trust that, once established, cannot be altered or revoked without beneficiary approval.

- Benefits: May offer tax advantages and greater protection from creditors or lawsuits.

- Considerations: Requires the grantor to relinquish control over the assets, and setup can be more complex.

3. Testamentary Trust

- Definition: A trust created by a will, activated only after the grantor’s death.

- Benefits: Allows specific conditions on asset distribution after death.

- Considerations: Must go through probate, and offers no benefits during the grantor’s lifetime.

4. Special Needs Trust

- Definition: A trust for a beneficiary with special needs, ensuring financial support without impacting government benefit eligibility.

- Benefits: Provides a reliable source of support while preserving eligibility for public assistance.

- Considerations: Strict limits on how funds can be used, often requiring a trustee’s oversight.

Trusts empower homeowners to control their legacy while minimizing probate hassles for heirs.

Pros and Cons of Placing Property in a Trust

As property management and real estate experts, we know that putting property in a trust can provide essential benefits for homeowners in Orange County. Here is a breakdown of the key pros and cons:

Pros:

- Avoid Probate: Property in a trust skips probate, saving time, money, and privacy.

- Enhanced Privacy: Trusts remain private, unlike wills that enter the public record.

- Control Over Asset Distribution: Trusts allow you to set specific conditions for when and how property is passed on, which is helpful for families with young beneficiaries or complex financial situations.

- Possible Tax Benefits: Certain types of trusts may reduce estate or inheritance taxes.

Cons:

- Initial Setup Costs: Establishing a trust can be costly due to legal fees and ongoing administrative work.

- Complexity: Trusts require careful planning and sometimes ongoing maintenance, especially for investment properties or multi-unit portfolios.

- Limited Asset Protection (in some cases): Not all trusts provide protection against creditors or lawsuits, depending on the type of trust.

Is Putting Property in a Trust Right for You?

Trusts are invaluable for property owners who want to avoid probate, protect privacy, and simplify inheritance for their loved ones. Whether you’re looking to streamline estate planning, reduce taxes, or safeguard a rental property portfolio, a trust can be a powerful tool.

With EJ Properties, you have the resources and expertise needed to manage property investments and plan for the future.

Related Reading

- Should You Put Your Investment Property in an LLC? – Alternatives to trusts for asset protection.

- Maximizing Property Value and Tax Efficiency – Tax strategies that may complement trusts.

Ready to Plan Your Property Legacy?

Our team at EJ Properties can connect you with estate planning resources and guide you on protecting your investments.

Get in Touch

Categories

Recent Posts